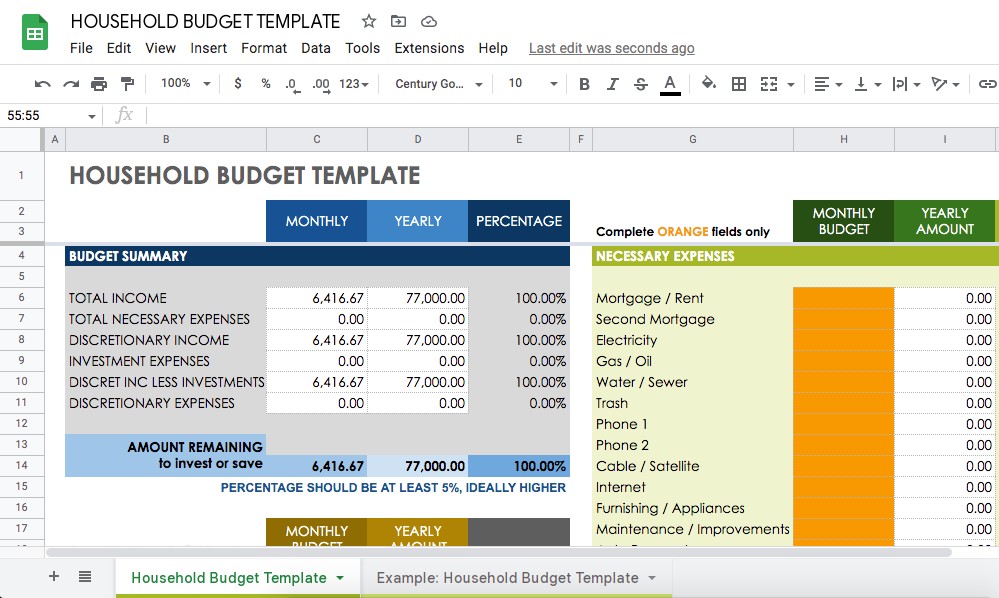

Household Budget Template Google Sheets. As a budgeting enthusiast, I understand the importance of having a well-organized budget plan. That’s why I provide you with the Household Budget Template Google Sheets that I have collected from the internet, and customized for your convenience. You can download the template to edit in Microsoft Excel, or copy the Google Sheet file to your Google Drive account. It’s important to note that in order to copy the Google Sheet Template file, you have to be logged in to your Google account first. These templates will make budgeting much easier for you and will help you achieve your financial goals. Take advantage of this resource today to help you stay on track with your budgeting.

Household Budget Template Google Sheets Files

Overview About Budgeting

Managing your household finances can be overwhelming, especially when you have multiple bills to pay and unexpected expenses that can throw off your budget. However, using a household budget template on Google Sheets can help you stay on top of your finances and make informed financial decisions. In this article, we will explore how to use the household budget template

Google Sheets to manage your finances effectively.

What is a Household Budget Template Google Sheets?

It is a free and easy-to-use tool that can help you manage your finances. It allows you to track your income and expenses, set financial goals, and analyze your spending habits. This template is available on Google Sheets, which is a free online spreadsheet program.

Features of a Household Budget Template Google Sheets

The household budget template Google Sheets comes with several features that can help you manage your finances effectively. These include:

- Income and expense tracking: You can track your income and expenses in one place and see your overall financial picture.

- Customizable categories: You can customize the template to your specific needs and preferences, including adding or removing expense categories.

- Financial goal setting: You can set financial goals and track your progress toward achieving them.

- Spending analysis: You can analyze your spending habits and identify areas where you can cut back to save money.

Benefits of Using a Household Budget Template Google Sheets

Using a household budget template on Google Sheets can help you make better spending decisions, save money, and reduce financial stress. With this tool, you can:

- Stay organized: You can keep all your financial information in one place and easily track your progress toward your financial goals.

- Identify areas for improvement: You can identify areas where you can cut back on spending to save money.

- Plan for the future: You can set financial goals and create a plan to achieve them.

- Reduce financial stress: You can reduce financial stress by knowing exactly where your money is going and having a plan to manage it.

How to Access and Customize a Household Budget Template Google Sheets

Accessing the Template on Google Sheets

To access the template, you will need a Google account. If you don’t have one, you can create one for free. Once you have a Google account, follow these steps to access the template:

- Go to the Google Sheets homepage.

- Click on “Template Gallery” at the top of the page.

- In the search bar, type “household budget” and press enter.

- Choose a template that meets your needs.

Customizing the Template to Your Needs

Once you’ve chosen a template, you can customize it to your specific needs and preferences. Here are a few tips to help you get started:

- Add or remove expense categories: You can add or remove expense categories based on your spending habits.

- Change the layout: You can change the layout of the template to make it easier to read and understand.

- Use conditional formatting: You can use conditional formatting to highlight important data, such as overspending in a particular category.

How to Use a Household Budget Template Google Sheets

Tracking Your Income and Expenses

To use a template, start by tracking your income and expenses. You can do this by:

- Adding your income: Add all sources of income to the template, including your salary, rental income, and any other sources of income.

- Categorizing your expenses: Categorize your expenses, such as housing, transportation, food, entertainment, and utilities.

- Inputting your expenses: Input your expenses for each category and update them regularly.

Categorizing Your Expenses

Categorizing your expenses can help you see where your money is going and identify areas where you can cut back to save money. Here are a few tips for categorizing your expenses:

- Use broad categories: Start with broad categories, such as housing, transportation, and food. You can always break down these categories into subcategories later.

- Be specific: Within each category, be as specific as possible. For example, under the food category, you can have subcategories such as groceries, dining out, and snacks.

- Be consistent: Use the same categories each month to help you track your spending and see trends over time.

Setting Financial Goals

Once you have tracked your income and expenses, you can use the household budget template Google Sheets to set financial goals. Financial goals can help you stay motivated and focused on your financial objectives. Here are a few tips for setting financial goals:

- Be specific: Set specific financial goals, such as paying off a credit card or saving for a down payment on a house.

- Be realistic: Set goals that are achievable based on your income and expenses.

- Set a timeline: Set a timeline for achieving your goals, such as six months or one year.

- Track your progress: Update your budget regularly to track your progress toward your financial goals.

Analyzing Your Spending Habits

The household budget template Google Sheets can help you analyze your spending habits and identify areas where you can cut back to save money. Here are a few tips for analyzing your spending habits:

- Use charts and graphs: The template comes with built-in charts and graphs that can help you visualize your spending habits.

- Identify areas where you can cut back: Look for categories where you are spending more than you need to, such as dining out or entertainment.

- Create a plan to cut back: Once you have identified areas where you can cut back, create a plan to reduce your spending in those categories.

- Track your progress: Update your budget regularly to track your progress in reducing your spending.

Frequently Asked Questions (FAQs)

- Is the household budget template Google Sheets free to use? Yes, the template is free to use and is available on Google Sheets.

- Can I customize the template to my specific needs? Yes, you can customize the template by adding or removing expense categories and changing the layout.

- Can I access the template on my phone or tablet? Yes, you can access the template on any device with an internet connection.

- How often should I update my budget? It is recommended to update your budget at least once a month to stay on top of your finances.

Using a household budget template Google Sheets can help you stay organized, identify areas where you can cut back to save money, and achieve your financial goals. By tracking your income and expenses, setting financial goals, and analyzing your spending habits, you can make informed financial decisions and reduce financial stress. Access the template today and take control of your finances.

MORE:

Google Sheets Budget Templates

Invoice Template for Google Docs