Google Sheets Budget Templates. Are you tired of using clunky, outdated budgeting software? Look no further than Google Sheets for all of your budgeting needs!

Heads up! read first before using these templates: How to make a copy of a file in Google Drive

Google Sheets Budget Templates

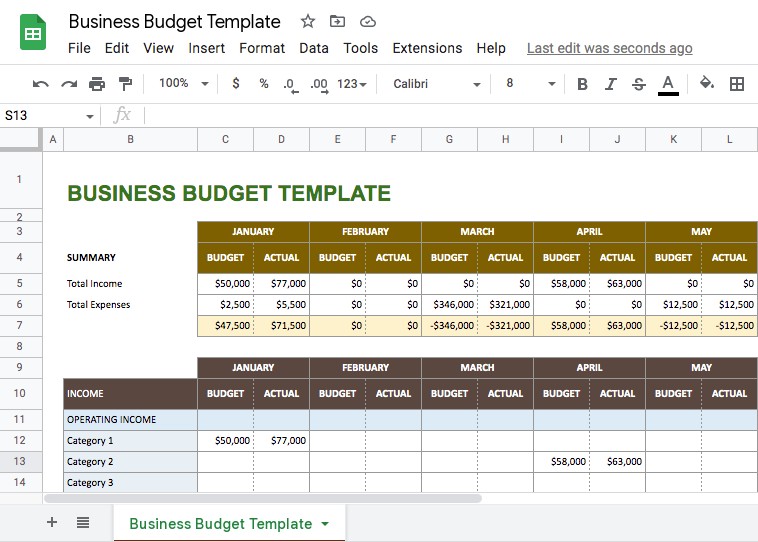

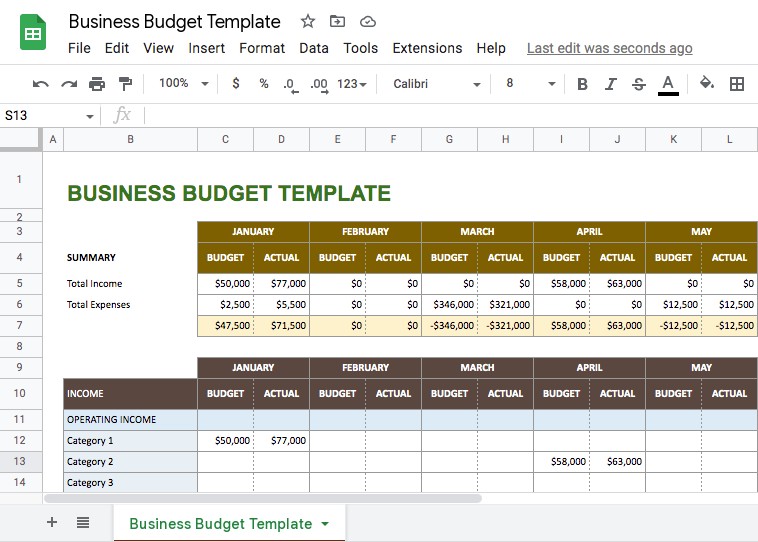

Business Budget Template

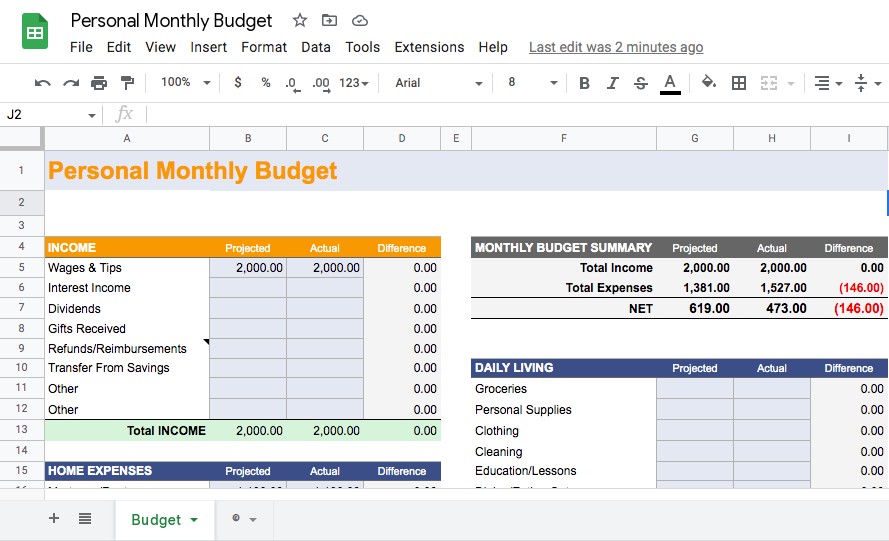

Personal Monthly Budget

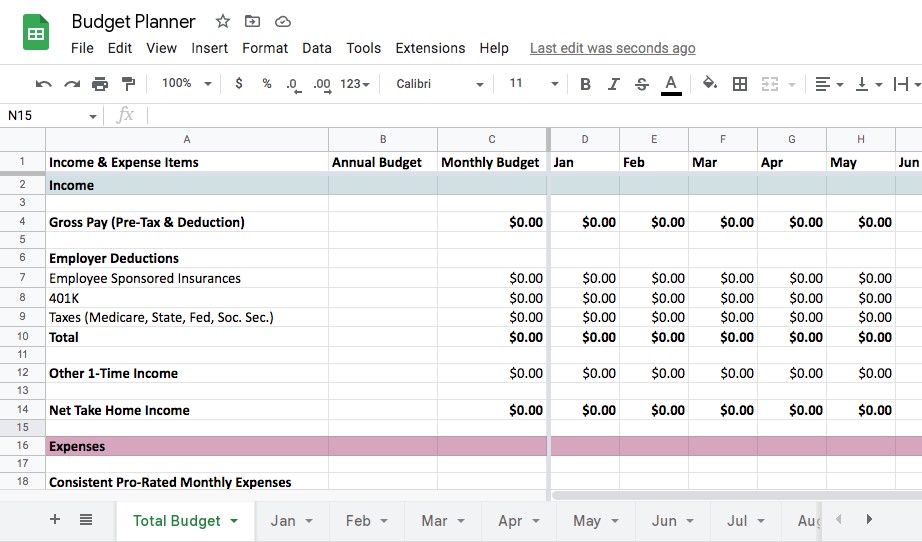

Monthly and Annual Budget Planner

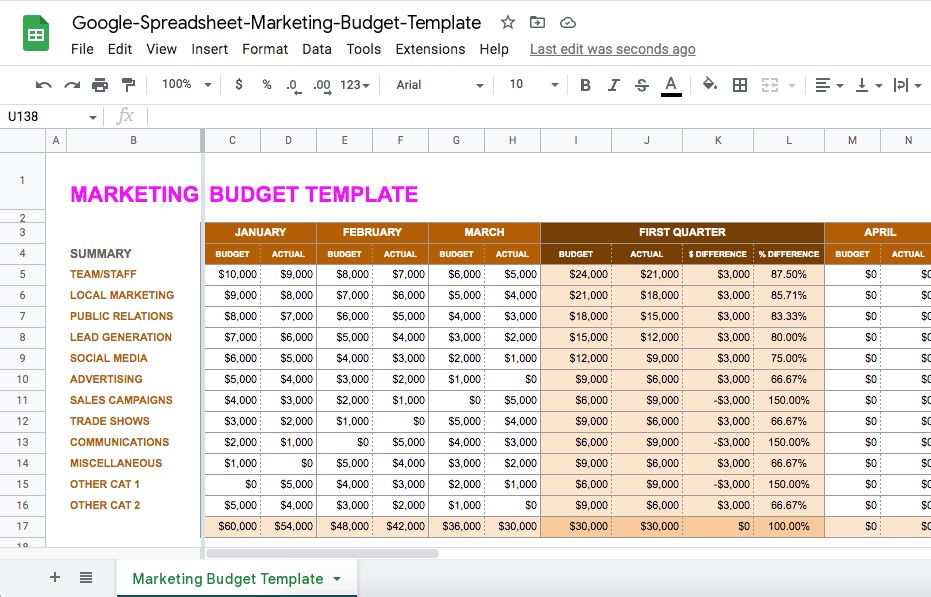

Marketing Budget Template

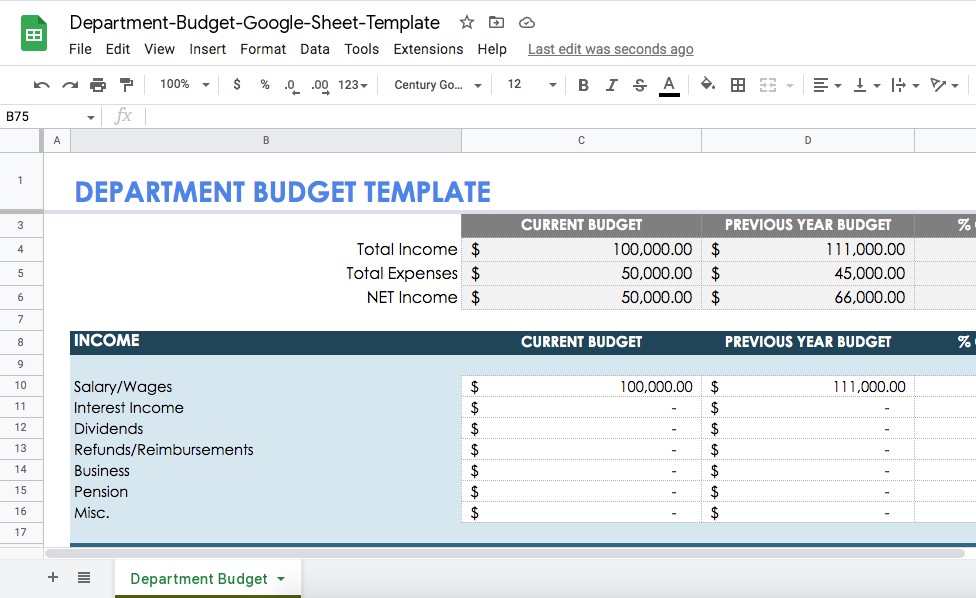

Department Budget

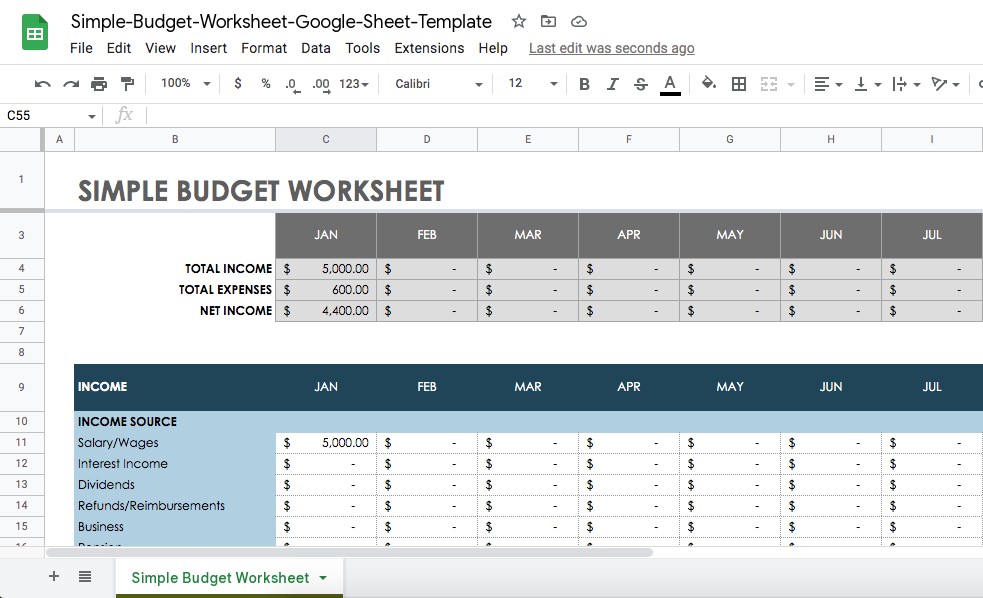

Simple Budget Template

Users also read: Free Google Docs Templates , Google Docs Business Card Template

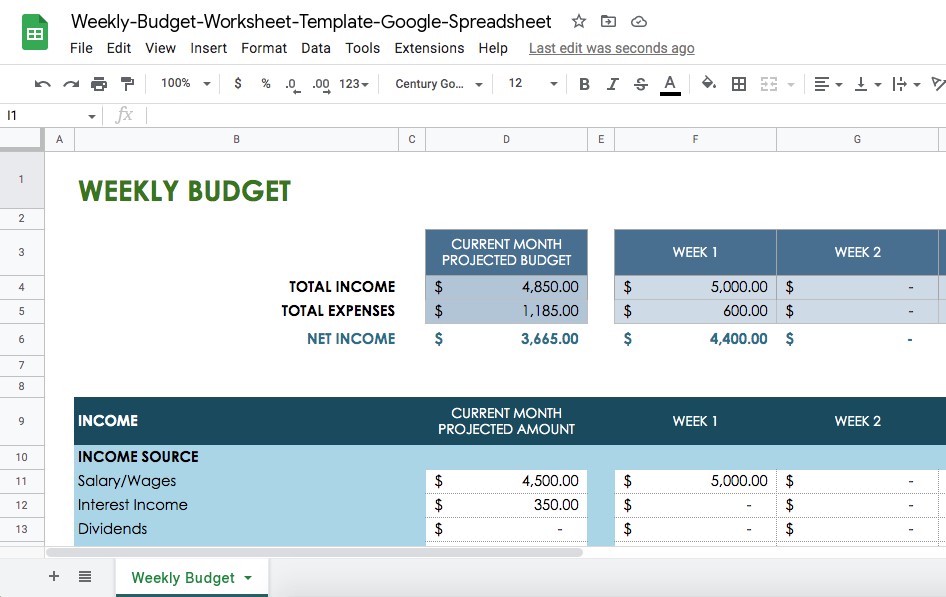

Weekly Budget Spreadsheet

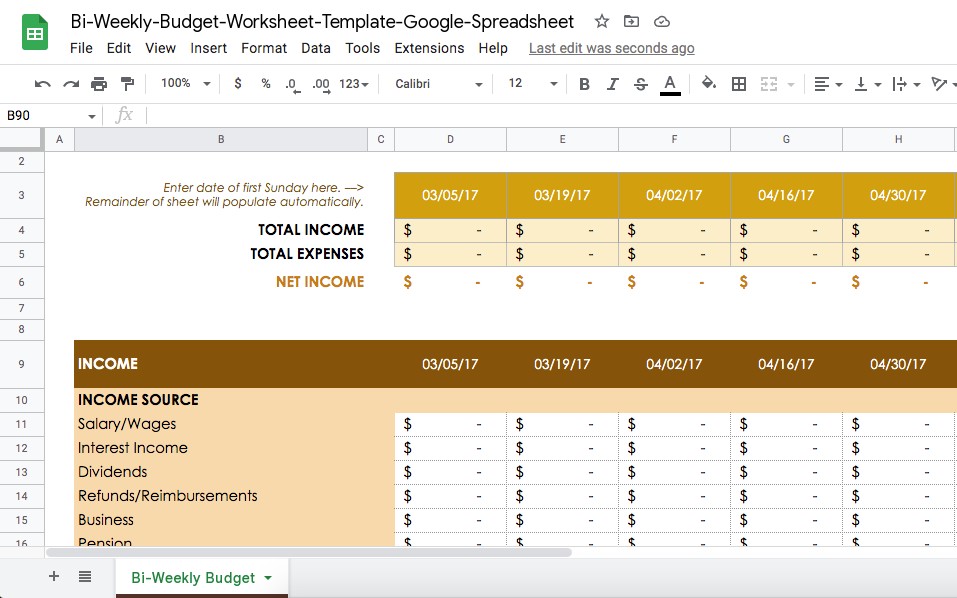

Bi-Weekly Budget

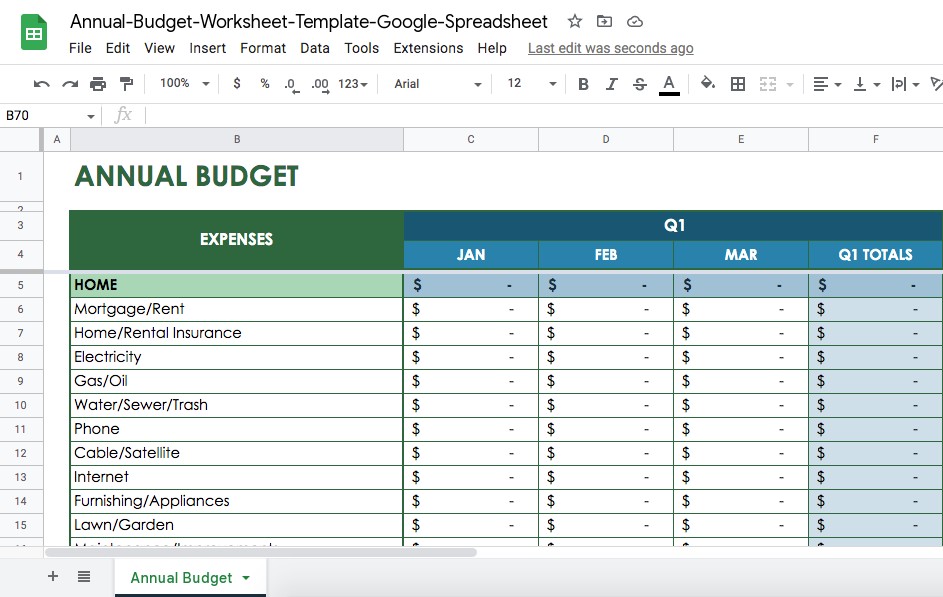

Annual Budget

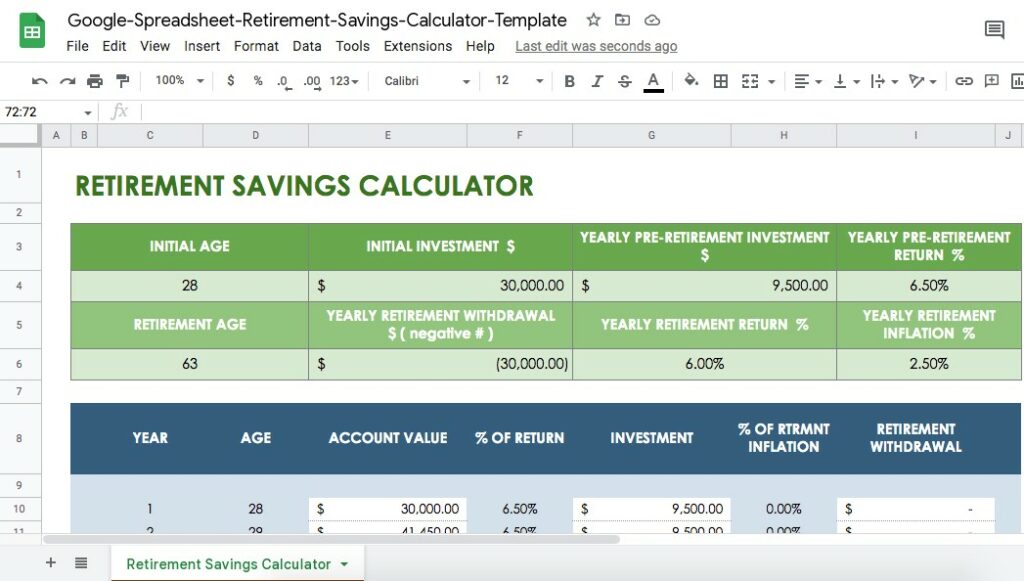

Retirement Savings Budget Template

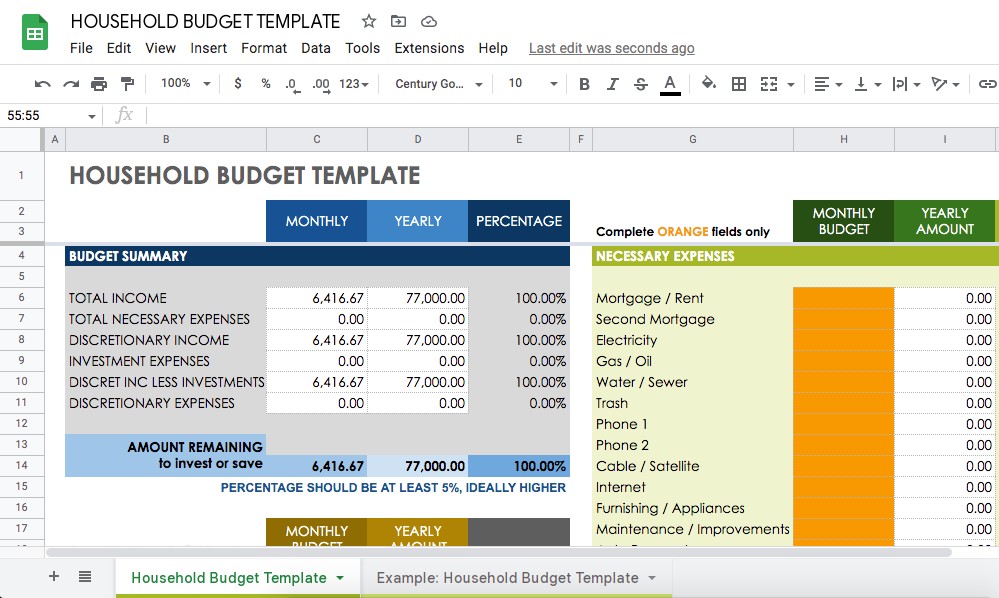

Household Budget

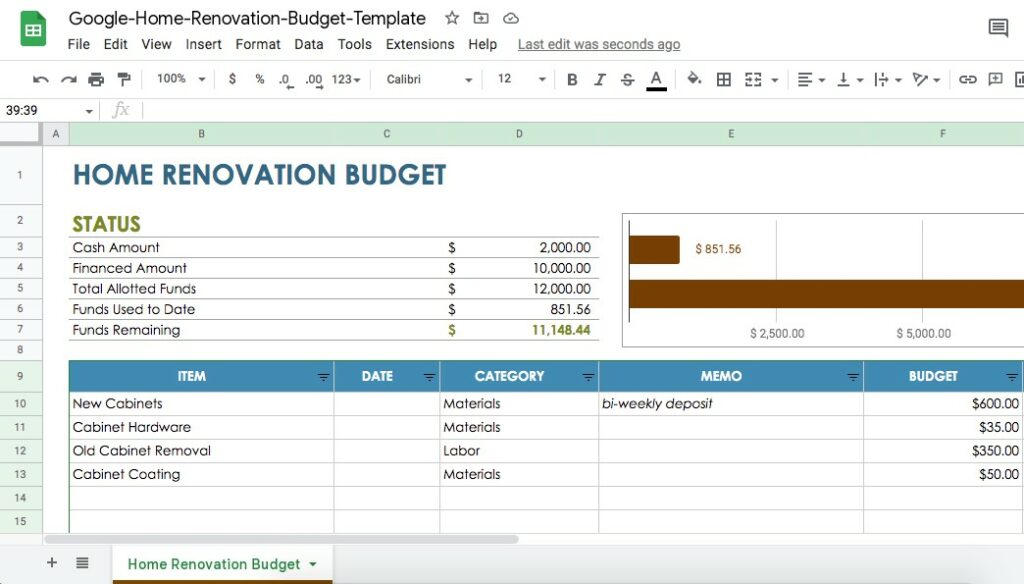

Home Renovation Budget

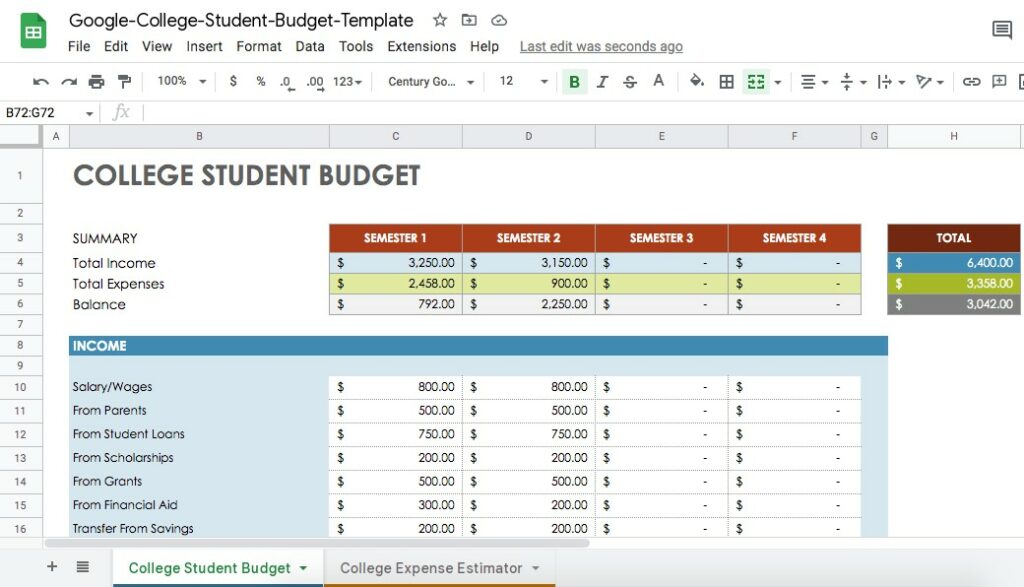

College Student Expense Estimator

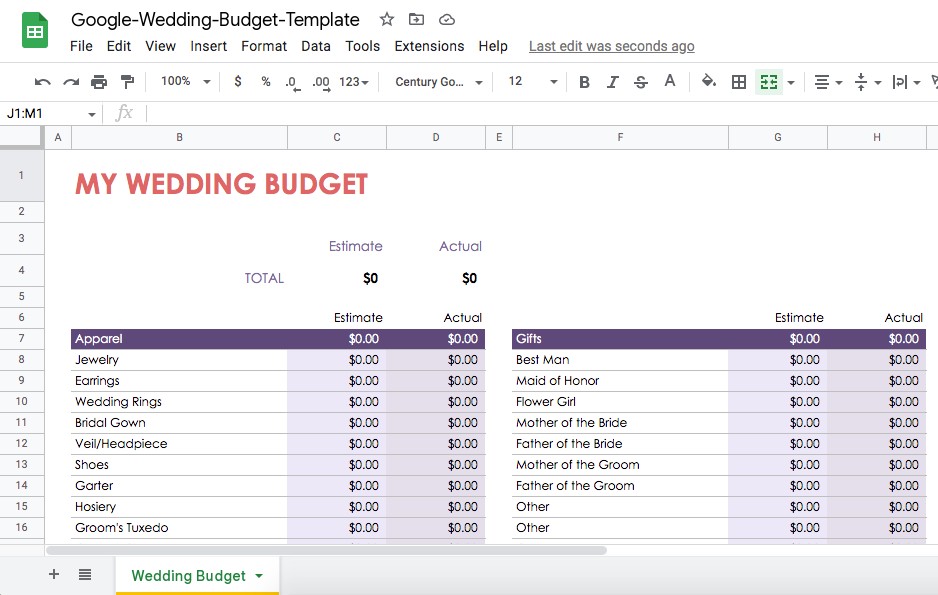

Wedding Budget

Soon: Google Sheets Budget Templates

The benefits of using Google Sheets for budgeting

Google Sheets is a free, cloud-based spreadsheet program that is part of the Google Docs suite of productivity tools. It is accessible from any device with an internet connection, making it easy to track and manage your finances on the go.

Types of budget templates available in Google Sheets

One of the best features of Google Sheets is the wide range of budget templates available. Whether you are a business owner, a student, or just looking to get your personal finances in order, there is a template that will suit your needs.

Some popular budget templates include:

- Personal budget template: This template is designed for individuals and families to track their income and expenses. It includes categories for bills, savings, and miscellaneous expenses.

- Business budget template: This template is perfect for small business owners who want to keep track of their income, expenses, and profitability. It includes categories for sales, marketing, and operational expenses.

- Event budget template: This template is great for planning and tracking the expenses of a special event, such as a wedding or corporate function. It includes categories for venues, vendors, and entertainment.

How to use budget templates in Google Sheets

Using a budget template in Google Sheets is easy. Simply choose the template that best fits your needs, input your data, and the spreadsheet will do the rest. You can even customize the templates to fit your specific budgeting needs.

Advanced features of Google Sheets Budget Templates for experienced users

In addition to the convenience and versatility of Google Sheets, it also offers a range of advanced features for more experienced users. These include the ability to create pivot tables, use functions and formulas, and collaborate with others in real time.

So why waste your time and money on expensive budgeting software? Give Google Sheets budget templates a try and take control of your finances today!

Information usually presents in Google Sheets Budget Templates

A budget template should include columns for different categories of expenses and income, as well as rows for each month or period you want to track. Here are some examples of the types of information that may be included in a budget template:

- Expenses:

- Housing (e.g., rent or mortgage payments, property taxes, insurance)

- Transportation (e.g., car payments, gas, public transportation)

- Food (e.g., groceries, dining out)

- Utilities (e.g., electricity, gas, water, internet)

- Health care (e.g., insurance, medical bills)

- Entertainment (e.g., movies, concerts, hobbies)

- Personal care (e.g., haircuts, clothing)

- Savings (e.g., retirement contributions, emergency fund)

- Other (e.g., gifts, travel, pet care)

- Income:

- Salary or wages

- Interest or dividends

- Rent or other passive income

- Other (e.g., gifts, side hustles)

A budget template may also include formulas to calculate the total expenses and income, as well as the difference between the two. This can help users track their budget over time and see how they are doing in terms of meeting their financial goals. Other helpful features that may be included in a budget template include the ability to track debt payments, set financial goals, and generate reports or charts to visualize spending and income data.

FAQ on Google Sheets Budget Templates

A budget template in Google Sheets is a pre-designed spreadsheet that allows users to input and track their financial expenses and income. It

To create a budget template in Google Sheets, you can either create a new spreadsheet from scratch or use a pre-designed template.

1. Open Google Sheets and create a new spreadsheet.

2. Create columns for different categories of expenses (e.g., housing, transportation, food, etc.).

3. Add rows for each month or period you want to track.

4. Input your expenses and income into the appropriate cells.

5. Use formulas to calculate your total expenses and income, and to track your budget over time.

To use a pre-designed budget template:

1. Open Google Sheets and click on the “Template Gallery” icon.

2. In the “Search templates” field, type “budget template” and press enter.

3. Choose a template that meets your needs and click “Use this template.”

4. Follow the prompts to input your expenses and income.

5. Customize the template to fit your needs, if desired.

To use a budget template in Google Sheets, follow these steps:

1. Open the budget template in Google Sheets.

2. Input your expenses and income into the appropriate cells.

3. Use the template’s built-in formulas to calculate your total expenses and income, and to track your budget over time.

4. Customize the template to fit your needs, if desired.

5. Review your budget regularly to ensure that you are staying on track with your financial goals.

Here are a few tips for using a budget template in Google Sheets:

1. Be as detailed as possible when inputting your expenses and income. This will help you get a more accurate picture of your financial situation.

2. Review your budget regularly, at least once a week, to ensure that you are staying on track with your financial goals.

3. Use the template’s built-in formulas to help you stay organized and to track your budget over time.

4. Customize the template to fit your needs. For example, you may want to add additional columns or categories to track specific expenses or income.

5. Don’t be afraid to make changes to your budget as needed. Life is unpredictable, and your budget should be flexible enough to adapt to changes in your circumstances.